A Personal Chronology

With resource sharing becoming a necessity, the currencies in which this is happening are now on the radar of a growing number of geeks, artists and activists. Let’s talk about the aesthetics of post-credit money, writes media theorist Geert Lovink.

“The personal is political.” This 1970s adagium of the feminist movement rarely gets applied to our financial situation. Money is a private fate. You’re doomed if you have and doomed if you haven’t. Making money (Ole Bjerg, 2014) is a capacity that only the fast boys of Wall Street possess while speculating with other people’s savings–the rest of us are busy scraping coins (1). With the recent stagnation of middle class incomes, everyday finance is becoming politicized. Debt is a public affair. After 2008 we can barely say: Wir haben es nicht gewusst. Can we finally speak of an emerging ‘virtual class’ consciousness? (2) With resource sharing becoming a necessity, the currencies in which this is happening are now on the radar of a growing number of geeks, artists and activists. How are you going to make a living? Let’s talk about the aesthetics of post-credit money. But before we do this, I want to look at how internet culture and financialization have come together over the past decades and why Silicon Valley has so far stopped us from using tools that redistribute resources.

Crisis of the 1980s

In the midst of the never-ending economic malaise of the 1980s, I went through an existential crisis of sorts. Like others of my generation, I was living off social welfare, making my home in squats, and hitchhiking between Amsterdam and West Berlin while confronted with the neo-liberal backlash of Reagan and Thatcher. Witnessing the sad decline of the autonomous movements and having said farewell to academia after grad school, there were little professional opportunities for us post-hippies pre-yuppies. I felt too much of an independent intellectual to identify with the journalist role model, and in 1987 I decided to label myself ‘media theorist’, wherever that would take me. I had recently joined the Amsterdam free radio movement and had been interested in media theory ever since I majored in ‘mass psychology’ at the University of Amsterdam. But how was a ‘media theorist’ going to make a living?

A good five years later I had still not improved my job situation but quit the dole anyway, by selling essays in the media arts context, giving lectures, doing some organizing work in the Amsterdam cultural scene (dominated by baby boomers) and working part-time at the Dutch national broadcaster VPRO, earning $700 (US) a month, barely more than a social security check. The world had tumbled into yet another recession. Regardless, ‘new media’ started to boom under speculative rubrics such as ‘multi-media’, ‘virtual reality’ and ‘cyberspace’. Soon after, in early 1993, I obtained internet access. With the help of my hacker friends I uploaded my archive of digital texts, which was already considerable since I had started using a PC in 1987. It was in this context that I had my first discussion about the absence of an ‘internet economy’. I was told that content was going to be ‘free’. Users had to pay an ISP in order to gain access and would also continue to purchase and upgrade their hardware such as PCs, screens, printers and modems. In the case of software, the situation wasn’t as clear-cut. From early on there were shareware and free software vs. corporate propriety ones; games were another grey zone.

1990’s: ‘text’ as first victim

My geek friends told me: if you’re not into old media or academia, try to find an arts grant, but do not expect the internet to provide you with an income. Find some boring day job, and express yourself the way you want to at night. Set cyberspace on fire. That’s the destiny of writing and all art forms. Become an entrepreneur and start your own business, learn some coding and become one of us. In 1993 serious money could be made with web design, but then again, that wasn’t content and looked like a hyped-up, temporary opportunity. Writing, be it journalism, fiction, poetry or criticism, would have to be financed through cultural funds or traditional publishers and become de-professionalized, or ‘democratized’, to put it in more friendly terms. The internet was going to disrupt all businesses, and ‘text’ was its first victim–a Napster moment avant la lettre.

The early nineties is a crucial period in the ‘dotcom’ saga. Its libertarian spirit was captured well by Richard Barbrook and Andy Cameron in their seminal piece The Californian Ideology from 1995 (3), but the text failed to analyse a few critical elements, such as the economy of the ‘free’ and the role of venture capital and the IPO in the business plan. Internet start-ups all follow the same scheme: above all attract a critical mass of users in a short period of time. Market share is more important than a sustainable revenue stream. In this cynical model it was accepted that most start-ups would fail, and their losses would be made up by one or two success stories that would be sold early or brought to the stock market.

It took me years to decipher Wired (sold and ‘kaltgestellt’ in 1998) and then Red Herring and Fast Company to get a deeper understanding of what the economic premises of the dotcom craze were about. There were hardly any books about it, and the critical literature was about zero—and before we knew it the market had collapsed. The multitudes at the time were active in counter globalization movements focussed on the IMF and Latin America, the worthy struggles of yesteryears. A classic study on how the internet ruined San Francisco, still worth reading, is Pauline Borsook’s Cyberselfish, which came out in 2000 (4). Then there were the hilarious daily accounts of the rise and fall of dotcoms published by the Fucked Company website. Our only academic guardian in the dark was Saskia Sassen, who linked global finance with computer networks. Her complex macro picture, together with Manuel Castells’ sociological account of the ‘network society’, gave solid overviews; however neither dealt directly with the madness of dotcom culture post Netscape’s IPO in 1995. From 1997 to 2000 billions of dollars flowed from pension funds, mutual funds, etc. into internet ventures. Only part of these investments ended up as ponzi schemes of fake e-commerce companies, such as pets.com and boo.com. A great deal of the institutional investments disappeared into fiber-optic infrastructure. None had revenue; all was based on future hyper growth schemes, fuelled by outside capital. Tens of thousands of designers, musicians, engineers and social scientists quickly retrained as HTML coders, communications and PR officers and IT consultants—only to find themselves unemployed again a few years later when the bubble burst.

One way to counterbalance the ruthless waves of privatization and the stock market craze was to point to the internet as a public infrastructure. The internet, with its military and academic background, should guarantee ‘access for all’. ‘We want bandwith’ was the slogan of our one-week long campaign at Catherine David’s Documenta X, as part of the Hybrid Workspace project. The same group, coordinated by Waag Society Amsterdam, where I used to work as a part-time fellow in that period, designed a similar Free for What? campaign out of the Kiasma museum in Helsinki, late 1999.

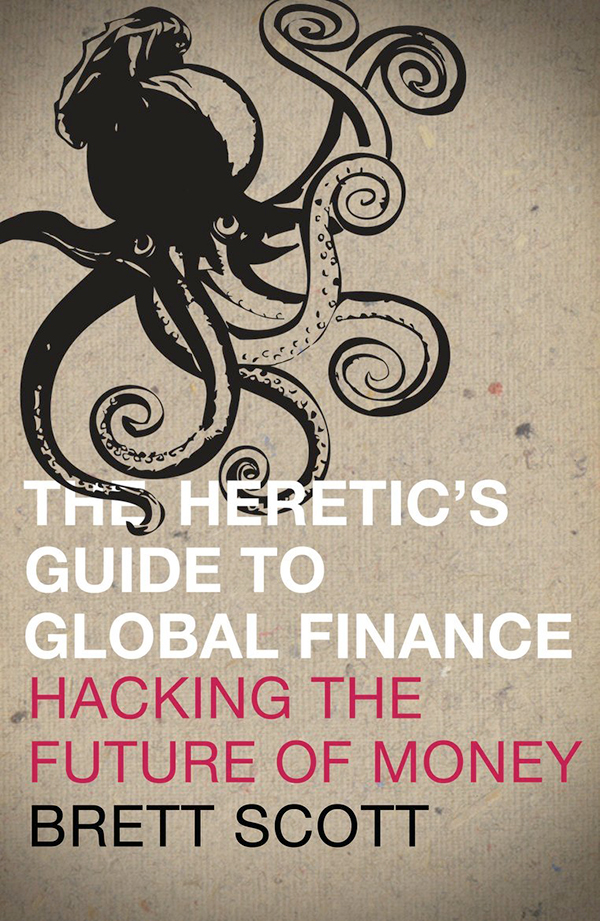

Delays in perception concerned me back then in the ‘roaring’ nineties, as it does now. Who benefits when we do not understand Facebook’s business model? Which factors turn us from heroic subjects into grumpy consumers who merely click? Even if we try hard, as individuals, and collectively in networks and research groups, why can we only understand the dynamics of contemporary capitalism retrospectively? Is this the real reason why we lack avant-gardes? These days we can only fight the causes of the last recession. It’s no different now as we deal years later with the fallout of the 2007-2008 crisis –as basic understanding of derivatives and high-frequency trading starts to spread (thanks to Scott Patterson, Michael Lewis a.o.), as unemployment caused by the Euro crisis remains at unimaginatively high levels, as stagnation becomes permanent and as budget cuts ravaging health care, culture and the economy as a whole remain stagnant, waiting for the next crash.

2000: Bubble burst

Ever since initiatives such as the nettime mailinglist took off (in 1995), collective efforts have been made to develop a ‘political economy of the internet’, drawing from cultural, political and economic perspectives from both inside and outside academia. In February 2000, right after the victory over the millennium bug and the announcement of AOL and Time Warner’s merger, the dotcom bubble burst. A belayed attempt to analyse the ‘New Economy’ and bring together critical voices from both sides of the Atlantic was the tulipomania.com event (Amsterdam/Frankfurt, June 2000), held right after the NASDAQ crashed (mid April 2000). The histories of the first stock market craze in the early 17th century, the South Sea bubble and the crash of 1929 are well known. And now it happened again right under our own eyes, even in our own sector, causing so much destruction.

2000-2010: This Is Not an Economy

Projects like tulipomania.com directed us to look at the larger picture of global finance: Wall Street, sovereign (hedge) funds and high speed trading. Why was it impossible to imagine sustainable sources of income for the non-technical workers who were so directly involved? Why did new media exclude artists and content producers and only reward a handful of entrepreneurs and technicians? With perhaps the exception of a few years of the boom, nothing changed much over a decade. This Is Not an Economy. In fact, soon after the explosion of the ‘dotbombs’, armies of web designers and project managers lost their jobs and returned to their hometowns and their old professions. In fact, the poverty of the ‘precariat’ was about to get worse. In the meanwhile, I had to make the move to academia after two decades of working as a free-floating theorist, getting a PhD in Melbourne based on my work on critical internet culture. What new media critics like myself experienced in 1990s soon spread to neighbouring professions such as theatre, publishing and film criticism as well as investigative journalism, photography and independent radio, all joining the impoverished ‘creative class’: cool but poor. With state subsidies withdrawing, the remaining paid jobs shifted to advertisement and PR.

After finding a research job back in Amsterdam, I was able to kick off the Institute of Network Cultures in 2004–a career move that many of my fellow critics and artists were forced to make. The first big event of my newly established research unit at the polytech Hogeschool van Amsterdam (HvA) was Decade of Webdesign (January 2005), an event that looked at the shifting economics of this young profession, followed by MyCreativity (November 2006), which discussed the misery of the ‘creative industries’ policies that had recently reached Europe from the UK and Australia. Due to the rise of blogs and ‘template culture’ in the immediate aftermath of the dotcom crash, it was no longer necessary to build a website from scratch. The prices of web design had plummeted. The geek inventors of the blog software had, once again, failed to build a monetary plan into their systems, and soon the hobbyists of ‘participatory culture’ fell prey to the same old ‘free culture’ logic, this time lead by visionaries such as Henry Jenkins, who was opposed to professionalizing internet writing and instead praised the democratic nature of ‘Web 2.0’ that became so easily exploitable by emerging intermediates such as Google, Amazon, Apple and e-Bay. A handful of bloggers were eventually able to make a living from the syndication of their content, combined with web banners and micro-revenues through click rates to Amazon and Google’s AdSense and AdWords. Eventually an even smaller number of bloggers ended up being taken over by the old media industries, with the Huffington Post remaining one of the more interesting cases: its co-bloggers went to court against its founder, who had cashed in hundreds of millions of dollars from the sales of her meta blog to AOL, refusing to share the profit with the content co-producers who had built up her reputation all along.

The following period, in which ‘Web 2.0’ consolidated into ‘social media’, has been characterized by the victory of the ‘winner takes all’ logic of venture capital-backed dotcoms. The internet economy turned out not to be a ‘free market’ but a breeding ground for monopolies, with libertarian cartels policing the Silicon Valley Consensus. The real estate and financial services driving the 2007-2008 crash did not affect the internet economy. Rapid growth continued, this time fueled by new users in Asia, Africa and the rise of smart phones and tablets. The internet economy, originally based on IT and the media industries, started feeding into other economic sectors, from retail and services to health care, logistics and agriculture. The ‘Vergesellschaftlichung’, as this process is called so neatly in German, turned the internet into a general processing machine, based on largely unknown protocols (guarded by US-dominated industrial bodies) that reproduce the ideology of the free. No single individual or profession, no matter how traditional, can escape its influence, primarily because IT is becoming so small and invisible (yet another obstacle to making the monetary aspects of data flows more visible—and disputable). In response to this ‘totalizing’ (Hegelian aka Orwellian) development, we have seen the rise of ‘internet criticism’ dominated by US authors (and fulfilling an old desire of nettime’s back in 1995), and a growing awareness of internet-related aspects in general debates (from the Decline of Attention and so-called ‘Arab Spring’ to Morozov’s techno-solutionism). This criticism encompasses the ‘parasitic’ privacy strategies of Facebook, Twitter and Google. In response, public awareness that ‘if you are not paying, you are the product’ has grown. However, this cynical knowledge, spread amongst the online masses, did not result in alternative practices. At least, not until Bitcoin and other cyber currencies came on the scene…

In the early nineties I envisioned internet-enabled readers reading online or downloading my essays for a small fee, using a built-in peer-to-peer micro-payment system, designed according to the distributed nature of the computer network. If data could flow in a decentralized matter, then why couldn’t small digital payments be attached to them? A variation on the direct payment method could be a subscription model or a card with small amounts on it. A group of hackers and crypto-experts in Amsterdam were working on this very idea. I visited a number of presentations by an American called David Chaum, the founder of Digi-Cash who was at the time based at UvA Computer Science (CWI) in the east of Amsterdam, one of the early internet nodes in Europe. In 1993 I produced a one-hour radio show with Chaum in which he explained his struggle against the US credit card companies, banks, the patents involved and the importance of anonymous, encrypted data for future online payment systems.

2013: MoneyLab and the age of monetary experimentation

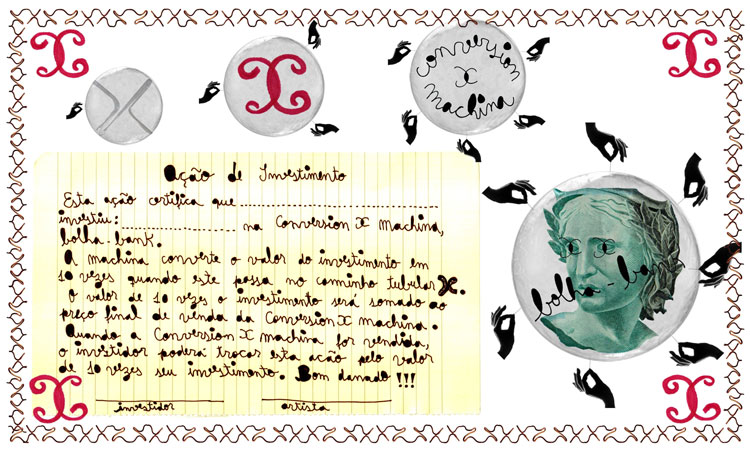

It is precisely this set of ideas that started to reappear again when bitcoin hit the surface in the immediate aftermath of the global financial crisis in early 2009, though this is is not the place to discuss bitcoin. In 2013 the Institute of Network Cultures kicked off a research network initiative in this field, entitled MoneyLab (5). The idea was, as always, to create multi-disciplinary dialogues between activists, artists, researchers, geeks and designers about creating peer-to-peer internet revenue models for the arts that combat exploitation and work towards a more equalitarian (re)distribution of the wealth that is being created online. A system that allows those who do the actual work to generate a decent income and that is no longer concentrated in the hands of founders and early movers.

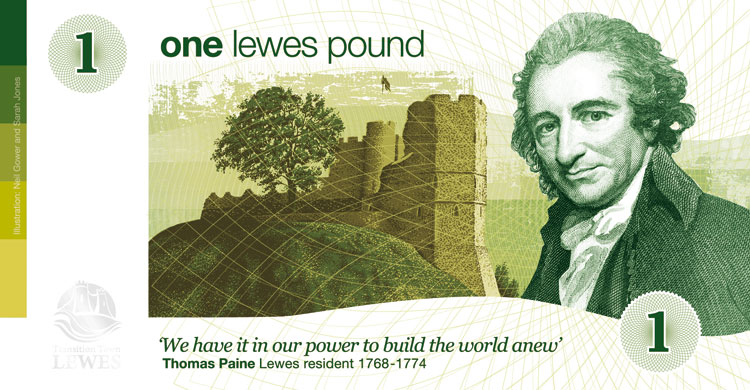

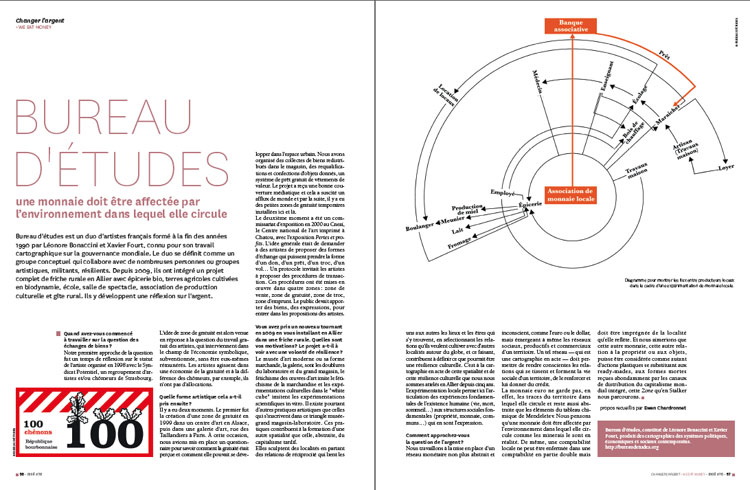

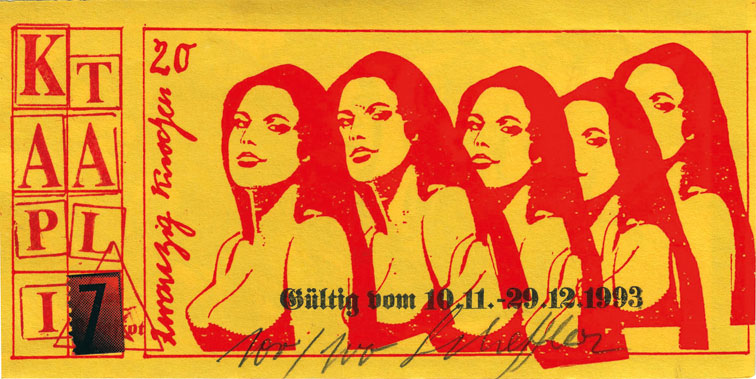

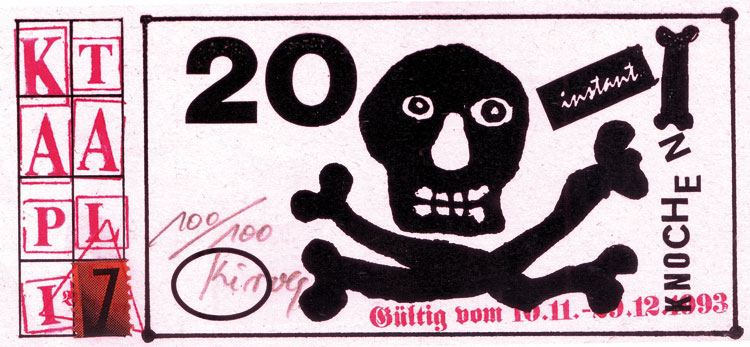

One thing is clear: the time of merely complaining about one’s precarity is over. This is the age of monetary experimentation. The premise of MoneyLab, this issue of MCD and many other initiatives investigate the multiplicity of complementary revenue models that do not have to function as overnight alternatives for the hegemonic payment systems. Starting off with local exchange trading systems, we can then move on to possibilities and traps of crowdfunding (before the artwork has been produced), to bitcoin and other crypto-currencies (payment systems after the artwork has been finished), to live payments in special currencies designed for online games. Please join the debates about their architectures and do not leave the geeks alone. Let’s start collectives, cooperatives and other forms of autonomous organization in order to counter the neo-liberal role model of the ‘entrepreneur’.

The rainbow of alternatives can only thrive within a larger context that fights for a global redistribution of resources. It is not enough to ‘resist the virtual life’. The aim should be to disconnect Silicon Valley from capitalist logic. A first step could be the ban of venture capital and its deadly ‘hypergrowth’ obsession. So far the Googles of this world have only made the rich richer. Next stop, after the encouraging San Francisco protests against the Google’s private commuter busses, is Occupy Mountain View. Give cyberspace back to the 99%.

Geert Lovink

published in MCD #76, « Changer l’argent », déc. 2014 / févr. 2015

Geert Lovink is a media theorist, internet critic and author of Zero Comments (2007) and Networks Without a Cause (2012). Since 2004 he is the founding director of the Institute of Network Cultures at the Amsterdam University of Applied Sciences (HvA).

> https://networkcultures.org/

(1) Making Money, The Philosophy of Crisis Capitalism, Ole Bjerg, Verso, London, 2014.

(2) See the classic text of Arthur Kroker and Michael Weinstein, Data Trash, Theory of the Virtual Class (New York, St. Martins Press, 1994) that suffered, like so many studies of its time, from a speculative overestimation of a ‘politics of the body’ related to ‘virtual reality’ and a relative neglect of the network capacities of internet and mobile phones, because the internet didn’t fit into French theory’s categories of the time.

(3) Cyberselfish: A Critical Romp through the the World of High-tech, Paulina Borsook, Little, Brown & Company, 2000.

(4) http://www.imaginaryfutures.net/2007/04/17/the-californian-ideology-2/ (5)

(5) The MoneyLab reader appears in March 2015 and can be downloaded there. http://www.networkcultures.org/moneylab